|

Back to Blog

Why Bonds Matter for Your Portfolio8/21/2023

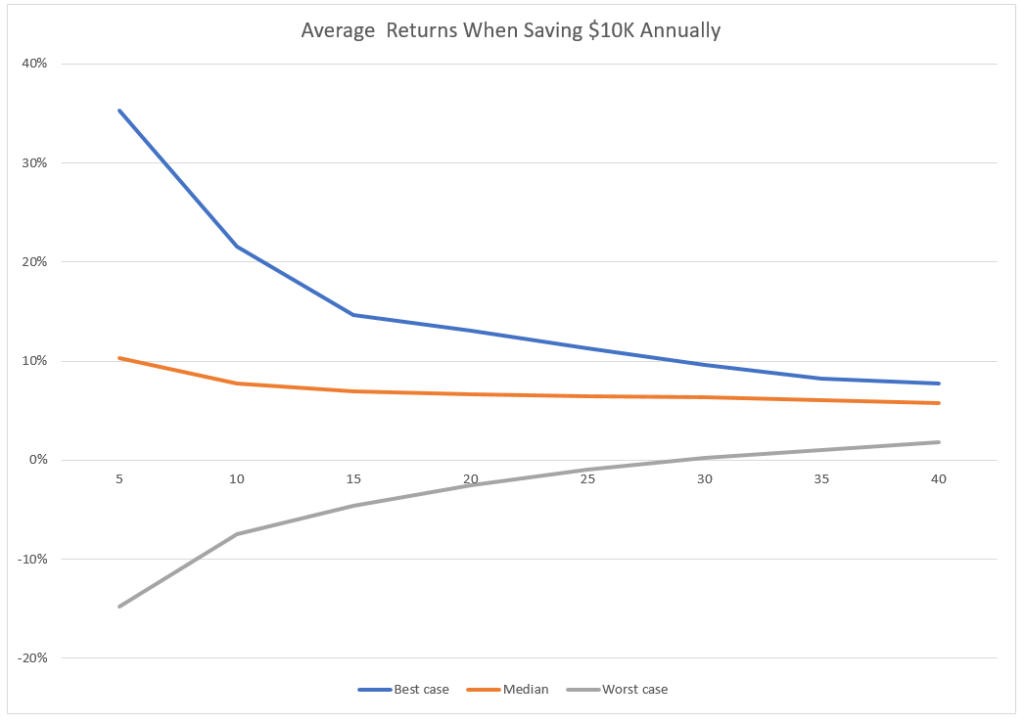

But can I challenge that idea? Argue (politely) bonds matter in some cases? And then because it’s pretty obvious to me a number of vocal investors and even investment advisors don’t understand the math? Would it make sense to quantitatively show both how bonds help and hurt? I think so. So let me keep going… The Big Bond MisunderstandingI’m not absolutely sure about this. But in discussing with many investors why bonds don’t belong in an investment portfolio, two facts seem to be what “bond haters” focus on. First fact? That over time, the average return on equities adjusted for inflation equals roughly 7% while the average return on bonds adjusted for inflation equals about 2%. Note: I calculated these returns using cFireSim.com and Microsoft Excel on August 21, 2023. At that time, the actual average real return of an all-stocks portfolio equaled 6.64%. The actual average real return of an all bonds portfolio equaled 2.14%. Second fact, that while stock prices and returns swing wildly from year to year, the variability dampens down over time. (This is true.) And this fact is often followed by a half-fact. If you can just hold stocks long enough, you win. (This is often the case but not necessarily true.) Often if some writer is talking about this “all stocks” strategy, she or he includes a chart that shows how as time passes the annual return on stocks “reverts to the mean.” Or “averages out.” Here’s a crude version of one these charts I whipped up for another blog post, Unreliability of Long-run Stock Market Returns.

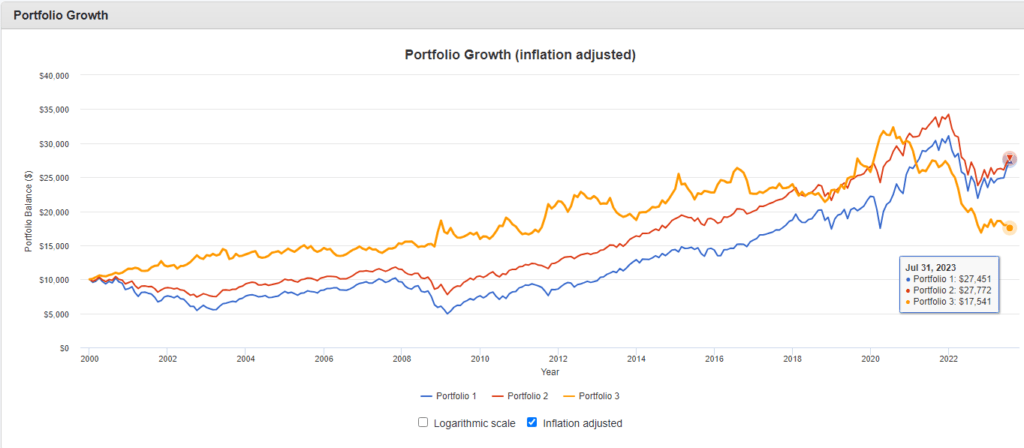

But chart above fosters a misunderstanding: We aren’t guaranteed to earn that better average return on stocks if we just hold on long enough. Yes, you or I will probably get a better result from an all-stocks portfolio. But we won’t for sure “guaranteed” get that. A significant chance also exists we’ll lose money with an all-stocks portfolio as compared to a balanced portfolio that includes stocks and bonds. Or that we’ll more likely run out of money in retirement if we use an all-stocks portfolio. Because of this reality, some people probably want to include bonds in their portfolios. Who? People willing to trade away the higher upside from stocks and the likely higher average return for dodging some worst-case scenarios. But Stocks Always Beat Bonds Right?I’m going to get pretty gritty about the details in a few paragraphs. But before I do that? Let me first show graphically a very recent example where an all stocks portfolio loses compared to a balanced portfolio which holds 70 percent in stocks and 30 percent in U.S. Treasury bonds. Figure 2 below shows a line chart the Portfolio Visualizer Backtest Portfolio tool draws for three example portfolios. The blue line shows a 100 percent allocation to US stocks. The red line shows a 70 percent allocation to US stocks and a 30 allocation to US long treasuries. And the yellow line shows a 100 percent allocation to US long treasuries.

Two observations. First, if you started in 2020, over the next two decades, an all-stocks portfolio (the blue line above) performed more poorly than an all bond portfolio (the yellow line above). The all stocks portfolio only catches up in year 21. (This shows in the chart when the yellow line crosses the blue line.) Second, even after more than 22 years? A balanced portfolio (the red line) beats the all stocks portfolio (again the blue line). No, you’re right. The all stocks portfolio may be ahead at year 25. Or year 30. (I hope it will be. I’m personally allocating 30 percent to US stocks.) But the line chart shown above doesn’t prove that if you or I just hold stocks long enough, we always win. In fact, it hints the opposite. Note: If you use US intermediate treasury bonds rather than US long treasury bonds, the all-stocks portfolio looks better. But not much. And the intermediate treasuries still do reduce your downside risk over a couple of decades. Calculating Downside Protection from BondsYou can use another Portfolio Visualizer too, its Monte Carlo simulator, to assess example effects of adding bonds to your portfolio. Specifically, you can use that tool to get an idea as to how much upside risk you give away by adding bonds, how the average return probably shrinks by adding bonds, and then how the downsize risk probably lessens by adding bonds. Just follow these steps, for example, to assess the downside risk avoided by adding bonds:

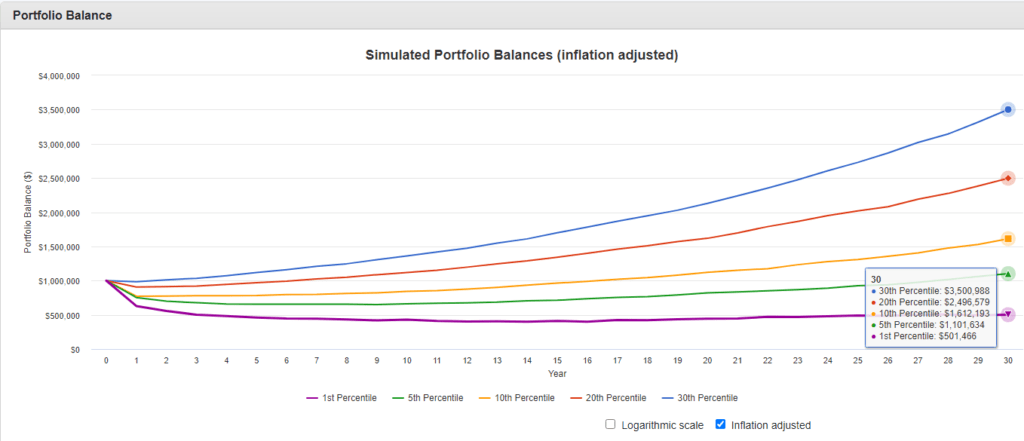

Figure 3 below shows the line chart with the first, fifth, tenth, twentieth and thirtieth percentile outcomes for an all-stocks portfolio based on historical returns. (Click the image to see a larger version of the chart.)

To see what a 70-percent stocks and 30-percent US intermediate treasuries allocation looks like, follow these steps:

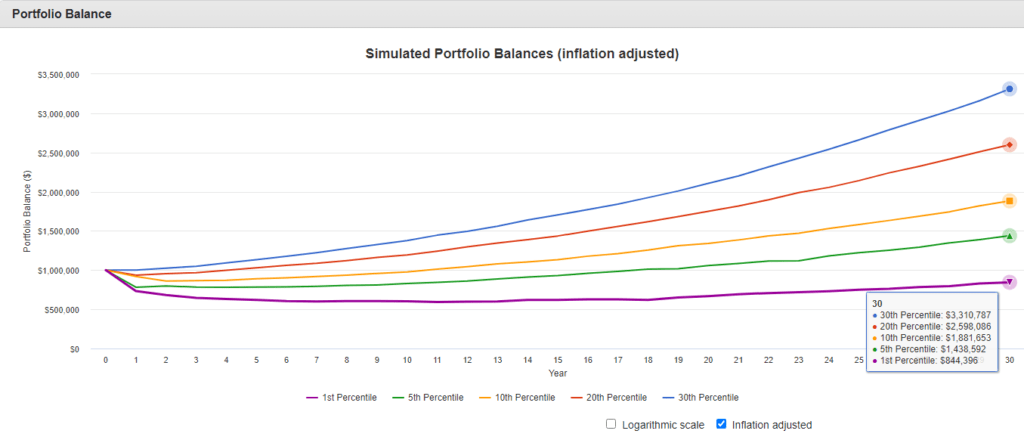

Figure 4 below shows the line chart with first, fifth, tenth, twentieth and thirtieth percentile outcomes based with an balanced portfolio generating historical returns

The big thing to note: The all-stocks portfolio’s worst-case scenarios? They’re worse, much worse, that the those that occur for a balanced portfolio. The “Do Bonds Matter” Simulation Summarized in a TableThe line charts in Figures 3 and 4 make it hard to see precise numbers. But the table below shows the ending values from the two simulations to make comparisons easier.

Let me specifically call out four observations. First observation, the calculations above don’t show actual three-decade long returns for the two portfolios. Not enough unique thirty-year historical outcomes “exist”. Thus, the simulation uses historical returns as the inputs to 10,000 different simulations. (The first percentile shows the average of the worst 100 simulations.) Also, note that if you run your own simulations using a starting value of $1,000,000, you’ll get slightly different ending values. That’s the nature of the simulation. Second, the risk minimization you get with bonds? You see that by comparing the first percentile, fifth percentile, and tenth percentile ending values. In all those cases, the worst-case balanced portfolio investor ends up with—per the simulation—a few hundred thousand dollars ahead of the worst-case all-stocks investor. That’s the example benefit of adding bonds. Again, note that the investor in this simulation started with $1,000,000. Third, somewhere between the 20th and 30th percentiles, the all-stocks portfolio beats the balanced portfolio. That makes sense. Most of the time, an all-stocks portfolio gives you a better return. That’s why you and I want to hold as large a percentage in stocks as we can. Especially early on in our saving. Fourth, you probably ought to go back and redo your simulations so you can see how well the 50th percentile, the 75th percentile and 90th percentile investors do too. Those investors make out like bandits by loading up on equities. Just So There’s Not a MisunderstandingTo close, four tangential remarks about this “bonds matter” argument. First, I’m not arguing everyone should load up on bonds. Rather, I’m trying to show quantitatively how bonds can reduce your downside risk. Second, for what it’s worth, I’m thinking a modest allocation to bonds. Something like 30 percent. (That’s my actual allocation.) Or 20 percent. Or maybe 40 percent. Third, I think we follow the suggestion of former Yale endowment fund Chief Investment Officer David Swensen and use U.S. Treasury Bonds and Inflation Protected Securities. (This suggestion from Swensen’s classic book, “Unconventional Success.“) Fourth, let me reference a couple of related blog posts. You might want to peek at our Unreliability of Long Run Stock Market Returns blog post because it includes a full discussion of that “just be patient everything evens out” line chart that people commonly misinterpret. And you might also want to look at another article here: Rate of Return of Everything Line Charts. That blog post may be worth skimming too to get a good visual sense of the variability of stock market returns in different countries and over the last 150 years. The post Why Bonds Matter for Your Portfolio appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/Vzxibwy

0 Comments

Read More

Back to Blog

But first a bit of background about what material participation is and why it matters. And then I’ll talk about how grouping activities sometimes makes a giant difference on your tax return. Why Material Participation MattersOkay, so here’s the main thing: You can’t deduct losses from a business venture or hands-on investment except if you materially participate in the activity. Example 1: Two brothers, Pete and Tom, invest in a new venture. Say a restaurant. The brothers agree to each invest $100,000 and will proportionally share the losses and the profits. Tom will also receive a salary from working in the business. Pete won’t work in the business. He’s keeping his regular job. If the first year, the business loses $100,000, each brother suffers a $50,000 loss. Tom, because he materially participates, can deduct that loss on this tax return. Pete, because he doesn’t participate at all, can’t. That’s the basic concept. The Seven Material Participation RecipesNext question: How does someone materially participate? Well, tax law provides seven recipes:

And one important wrinkle to this discussion for married people. Spouses combine hours to determine material participation. For example, if two spouses each spend 300 hours, the total material participation hours equals 600 hours. Grouping Activities: Backdoor Material ParticipationIf you don’t materially participate using one of those seven recipes just listed, however? You have one other gambit you can maybe use: Grouping activities. The best way to understand grouping is to copy and paste an example from the relevant Treasury regulations at 1.469-4(c)(3): Example 2: Taxpayer C has a significant ownership interest in a bakery and a movie theater at a shopping mall in Baltimore and in a bakery and a movie theater in Philadelphia. In this case, after taking into account all the relevant facts and circumstances, there may be more than one reasonable method for grouping C‘s activities. For instance, depending on the relevant facts and circumstances, the following groupings may or may not be permissible: a single activity; a movie theater activity and a bakery activity; a Baltimore activity and a Philadelphia activity; or four separate activities. Moreover, once C groups these activities into appropriate economic units, paragraph (e) of this section requires C to continue using that grouping in subsequent taxable years unless a material change in the facts and circumstances makes it clearly inappropriate. I boldfaced key part of the copied text above. But let me summarize how I think you read this. A taxpayer invested in and works in four activities. Possibly she or he doesn’t materially participate in an activity at least using one of the usual recipes. But the taxpayer can combine activities in any reasonable method. And once activities get aggregated? Probably, the taxpayer does materially participate. For example, maybe the taxpayer in Example 2 doesn’t qualify as materially participating in the bakery in Philadelphia. And maybe she doesn’t qualify as materially participating in the bakery in Baltimore either. But if she or he combines the Philadelphia bakery with the Baltimore bakery? Maybe that works. Rules for Grouping ActivitiesAs noted earlier, you can use “any reasonable method.” The Treasury regulations flesh out what that means. And they provide some logical instructions. You need to look at all the relevant facts and circumstances. Further, a logical handful of factors should be given the “greatest weight” in determining whether it’s reasonable to treat “more than one activity as a single activity:” I’m going to again copy and paste the actual language from the regulations. (See the bulleted list below.) But think about how these apply to the fictional business owner with bakeries and movie theaters in Baltimore and Philadelphia.

Limitations on Grouping ActivitiesBecause grouping activities is so potentially powerful, limitations exist. You can’t group a rental activity with a non-rental trade or business except in usual situations. (We’ve described those situations in another blog post here: A Dozen Ways to Deduct Passive Losses. But the common exception to this limitation: You can ignore this limitation when one of the activities is insubstantial in relation to the other. Another common exception: Self-rental situations.) You can’t group real property rentals with personal property rentals. You can’t group limited partner and limited entrepreneur activities except when the activities are in the same type of business. (This limitation applies to farming; movie and video production, distribution and holding; leasing Section 1245 property (so mostly depreciable personal property); oil and gas exploration; and geothermal exploration.) But other than these limitations? In many cases, business owners should be able to group activities to achieve material participation. If they need to. Grouping Activities PaperworkYou or your tax advisor need to add some paperwork to your tax return to group activities. For example, you include a grouping election with the first tax return you combine activities. If facts and circumstances change and the original grouping no longer makes sense? You regroup and disclose that action on the first affected tax return. If you haven’t made a grouping election but should have? Yeah, you should talk to your tax advisor about that. Typically, you can make a “backdated” grouping election. One predictable and fair caveat? The IRS may regroup activities if (1) a group is “not an appropriate economic unit” and (2) a “principal purpose” of the grouping was to “circumvent” Section 469’s passive loss limitation rules. Crazy Grouping Activities Examples That WorkLet me share three example groupings that probably work. Example 3: A contractor works full-time in his own construction business. His spouse spends 50 hours a year on a short-term rental business—which tax law doesn’t consider a rental activity. But the short-term rental housekeeper spends 80 hours a year. Thus, without grouping the businesses? The taxpayers can’t deduct short-term rental losses. However, if the couple groups the activities, they achieve material particpation. Note that it should be reasonable to group these activities. In addition to the common ownership and control, the husband maybe does construction and repair work in both activities. And then the wife may do the accounting in both activities. Example 4: A real estate broker qualifies as a full-time real-estate professional, and also spends 75 hours per property per year managing two rental properties. But if he uses separate landscapers for each property and the two landscapers each spend 100 hours a year? He doesn’t materially participate and won’t be able to deduct rental losses. Unless he groups. And in that case, bingo, he material participates. Because his 150 hours exceeds the 100 hours spent by either of the landscsapers. (As mentioned earlier, you can’t group his real estate sales activity with the rental activity.) Example 5: A taxpayer rides horses professionally (one activity) and operates an interior design business that specializes in equestrian-themed home interiors (another activity). Very possibly, she can group the horseriding with the interior design. Risk exists here that the IRS might see the horse business as a hobby, something I discussed here: What Ms. Topping Learned. But ignoring the hobby loss issue, if someone owns and operates two businesses that together create synergies? Grouping might be reasonable. (Be sure to consult your tax advisor if you want to try something like this.) A Final Caution HereAnd let me end with a caution. The IRS regularly rejects taxpayers grouping an airplane business with another business. Which maybe doesn’t seem to matter to you if you don’t own an airplane. But the rejected airplane activity groupings highlight a risk. The pattern that seems to show up when the IRS removes an airplane business from grouping? Common ownership and control isn’t enough. You need more than that. You want interdependencies or similarities in the activities. Probably some synergy. And then you don’t want huge differences in the activities. (Grouping a doctor’s office with an airplane charter, for example? Yeah, that’s stretch.) Other Related Resources:Real Estate Professional Audits Surviving Short-term Rental Audits

The post Grouping Activities to Achieve Material Participation appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/5BhQaTu

Back to Blog

Adapting During Times of Crisis7/20/2023

The concept of adaptability refers to the ability to adapt to new situations and circumstances. This is a skill that every person should have, as it allows them to function seamlessly in the world around them. Without it, they would be unable to adapt to the changes brought about by different situations. It has been said that the ability to adapt faster than others has allowed humans to flourish since caveman days. There are many ways for companies and individuals to handle a crisis. The trick is knowing when to adapt and change and when to seek outside help. Have Multiple Plans Having multiple plans is one of many ways a company can quickly adapt to change and crisis. For example, look at how companies handled the pandemic. Those that shifted directions survived, while others struggled and failed. Although many companies were able to alter their plans due to the outbreak, it’s still essential to have a Plan B in place before it’s needed. A Plan B helps people plan for the future and ensure they have the necessary resources to get through the situation. Business Analysis Before you start implementing a crisis management strategy, it’s important that you first analyze the current state of the business environment. This step will allow you to make data-driven suggestions. Besides the current situation, you also look closely at the market and the company’s potential risks. You can also get a better idea of how you can distribute your resources by researching the market and examining your customers’ preferences. A crisis management tool is also known as business analysis, which involves constantly monitoring the environment and assessing the impact of the initiatives that have been carried out. It can help increase the value of your company’s services and products. Be Ready to Tighten the Belt One of the most critical components of a crisis management plan is the ability to manage finances in unstable conditions. This strategy can help prevent the company from going bankrupt. In this episode, we’ll talk about risk management, which is becoming more prevalent in today’s environment. This discipline can help managers identify and mitigate the risks they encounter while working on new projects. Know Your Limits After learning about the situation during the pandemic, many companies were able to develop effective protocols. These routines had to be changed, which involved time, learning, and sacrifice. Although building procedures for every situation has its limits, it’s up to businesses to decide when to adopt them. The post Adapting During Times of Crisis first appeared on Cuyler Pagano | Business & Entreprenuership.via Cuyler Pagano | Business & Entreprenuership https://ift.tt/YtugsFM

Back to Blog

And here’s why: Washington state now levies a seven-percent capital gains tax on (1) the net long-term capital gains residents realize and (2) the Washington-state-y net long-term capital gains that nonresidents realize. But if you’re a small business owner or entrepreneur? You can probably avoid the capital gains tax on the sale of a small business. Because the law includes a qualified family-owned small business deduction. A warning though: Washington state’s new capital gains tax is complicated. And the most complicated bit? The small business loophole you may want to use. The Washington Capital Gains Tax in a NutshellBut let me briefly explain how the Washington capital gains tax works. And then I’ll get into the gritty details of the qualified family-owned small business deduction (aka, the “QFOSB” deduction.) So the big picture on this Washington capital gains tax. The state levies a seven percent tax on the net long-term capital gains an individual taxpayer realizes. However two wrinkles here: First, the law exempts a bunch of special-case capital gains, including most capital gains on real estate, gains from selling depreciable property, and for specific industry situations. (For a complete list of the exemptions, you can refer to a blog post over at our CPA firm website: Washington State Capital Gains Tax Planning.) And then the second wrinkle. The law provides three deductions: A standard $250,000 deduction (so the first $250,000 of gain is never taxed). A charitable contribution deduction of up to $350,000, which is an alternative to the $250,000 standard deduction. (You would use the alternative charitable deduction only if it exceeds the standard deduction.) And then a qualified family-owned small business deduction. Note: Those amounts in the preceding paragraph get adjusted annually for changes in the Seattle-area consumer price index. The actual standard deduction for 2023, for example, should be eight or nine percent higher. Deduction Detail #1: Gross Revenues $10 Million or LessA first thing to know about the QFOSB deduction: To be a small business, a firm’s worldwide revenues for the twelve-month period prior to the sale or exchange need to equal $10,000,000 or less. (This value also gets adjusted for inflation. So if you’re looking at a sale in 2023? The value might be closer to $11,000,000.) But note that the tax doesn’t look at the capital gain, as the following two examples highlight: Example 1: George developed and patented artificial intelligence software. After several years of development, annual revenues average less than $1,000,000 a year. But a large technology company buys his business for $100,000,000. He should qualify for the full qualified family-owned small business deduction on the $100,000,000. Example 2: George’s wife Martha starts an ecommerce business and slowly grows the business to $12 million in revenues. After George sells his business, she sells her firm in 2022 for $500,000 based on the firm’s annual profits. (Profits roughly run $200,000 a year.) Probably half of her $500,000 of capital gains, or $250,000, gets taxed. Her business? Too big to use the QFOSB deduction on her tax return. Deduction Detail #2: Three Families or Fewer ControlThe next thing to know. The QFOSB deduction only works for an interest in a family-owned business that meets, and here I use the language of the statute, one of the following characteristics:

The Washington capital gains tax law, by the way, says a taxpayer’s family members include ancestors (so parents and grandparents of the taxpayer, for example), spouses and state registered domestic partners, lineal descendants, lineal descendants of a taxpayer’s spouse or state registered domestic partner, and finally, the spouse or state registered domestic partner of a lineal descendant. (These definitions come from Revised Code of Washington Section 83.100.046.) Example 3: George and his wife Martha along with their good friends John and his state registered domestic partner Abigail start a small business. Initially they each own half. Later on they sell a third of the company to a venture capital fund. If they subsequently sell the business, because their two families together own less than 70 percent, they won’t get to use the QFOSB deduction. Note that had they sold the firm before raising venture capital? Yeah, they would have qualified. One thing to note here: The new law doesn’t define what a business is. But a reasonable guess is that the definition used for federal income taxes works. For example, the Section 162 standard established in a famous U.S. Supreme Court case, Commissioner v Groetzinger, says a business is an activity conducted in pursuit of profit and carried on with regularity and continuity. (Groetzinger was a professional gambler, by the way.) One would think that all the common business forms “qualify” for the qualified small business interest deduction: sole proprietorships, partnerships, regular “C” corporations, S corporations, LLCs operating as a proprietorship, partnership or corporation, and so forth. But an awkward reality: We don’t at this point know for sure how the state defines a “business.” (For example, federal income tax laws say a real estate rental activity may rise to the level of a trade or business. Yet who knows how the state sees this issue.) Deduction Detail #3: Sell Substantially All of the Business or the InterestAnother detail you need to know to assure the deduction: The business owner needs to sell at least 90 percent of her or his interest or the owners need to sell at least 90 percent of the business’s real property, taxable personal property, and intangible personal property. Example 4: Washington and Adams, a land surveying partnership with two owners, sells all of the assets of their business for a $1,000,000 capital gain. The two owners share the $1,000,000 equally. Assuming all the other requirements are met, each owner shelters their proportional $500,000 gains with the QFOSB deduction because they’ve sold 100 percent of the consulting business. Example 5: Jefferson and Burr operate a law firm as equal partners. Burr wants to sell his 50 percent interest in the law firm to a young new partner, Clinton, and then retire. When Burr sells his 50 percent interest to Clinton, he realizes a $500,000 capital gains tax and he also avoids the Washington capital gains tax on the $500,000 gain. The reason? He sells 100% (so more than 90%) of his interest in the business. Note: The statutory and administrative guidance available from Washington state provide no guidance on whether an existing business might be split into two or more separate businesses. For example, in Example 4, could Washington and Adams split the land survey firm into two businesses—say a Virginia operation and a Massachusetts operation—prior to the sale? And then they could possibly sell substantially all of one of those businesses? I would guess this does work. And here’s why: In the July 2023 administrative rules’ Example 11, the Department of Revenue describes how a real estate gain potentially subject to capital gains tax can be “moved” into another entity and so escape the tax. Deduction Detail #4: Hold Interest for Five YearsThe usual time frame required to receive long-term capital gain treatment on a federal and most other state income tax returns is more than one year. But to enjoy the qualified family-owned small business deduction, a taxpayer needs to have held her or his interest in the business, either directly or beneficially, for at least five years immediately preceding the sale. And while a mere change in the form of the business doesn’t necessarily restart the five year countdown, the change in form needs to not change the proportions of any beneficial ownership interest. (This last requirement comes from page 12 of the July 2023 administrative rules.) Example 6: James starts a restaurant on January 1, 2020 and operates as a sole proprietor for two years. He then incorporates the restaurant and elects Subchapter S status two years later on January 1, 2022. He sells the restaurant on December 30, 2024 and realizes a $1,000,000 capital gain. Because he sells the business one day short of five years? He will pay the capital gains tax on a portion of the $1,000,000. (Partial days count as full days per the statute. So if he’d sold on December 31, 2024 or later, he could have taken the deduction.) Note that the change in the form of the business ownership—a sole proprietorship for two years and then an S corporation for almost three years—doesn’t matter because James’ ownership percentage doesn’t change when the form of the business changes. Example 7: John, James’s brother, also started a restaurant on January 1, 2020 and then owned and operated it for a full five years, selling the restaurant on January 1, 2025. John operated the restaurant as a sole proprietorship for the first two years and then as an S corporation the remaining three years. When he elected Subchapter S status, however, he allowed his key employee to acquire a five percent interest in the S corporation. Unfortunately, he fails to qualify for the qualified family-owned small business deduction. Why? Because his changed ownership percentage in the S corporation “form” of the business restarts the five-year holding period. Deduction Detail #5: Taxpayer or Family Materially ParticipatesA material participation rule exists for the QFOSB deduction: Either the individual or a family member owning the business needs to materially participate in the business for five of the ten years immediately preceding the sale unless the sale is to another member of your family. To determine material participation, the Washington statute basically regurgitates Section 469 of the Internal Revenue Code, which says material participation means a taxpayer needs to be involved in the operations of the activity on a regular, continuous and substantial basis. And then the statute says material participation has the roughly same meaning as the Section 469 statute and its regulations. (The actual statute says, “…‘materially participated’ must be interpreted consistently with the applicable treasury regulations for Title 26 U.S.C. Section 469 of the internal revenue code…” The administrative rules then soften the consistently requirement with a rule to “generally” apply the 469 regulations.) A note: The Section 469 temporary regulations provide seven methods of achieving material participation. Only the first three methods, which set time-spent thresholds (more than 500 hours a year or more than 100 hours when no one works more or substantially all of hours), appear to work well. The regulations’ other material participation methods appear not to work. (For federal income tax purposes, participating three years in a personal service activity gives the participant permanent material participation status, for example. Even decades later.) Deduction Detail #6: Document Material ParticipationA related material participation thing. Material participation from any member of the family of the taxpayer apparently counts for the entire family. But surely many family-owned small business owners have not been documenting their participation. And for a good reason: They haven’t needed to. Internal Revenue Code Section 469 and the companion Treasury regulations use material participation to determine when individual taxpayers claim passive activity losses and use passive activity tax credits. That’s exactly the opposite of what Washington state wants. The state uses the passive loss material participation regulations to determine if individual taxpayers report taxable income. The practical problem in this misapplication? Profitable “qualified family-owned small business” businesses probably won’t have been tracking their material participation at least before now. Because they didn’t need to. But now they should. Probably. So they can later prove material participation. Deduction Detail #7: Consider (Reconsider?) Activity GroupingsOne other wrinkle related to Section 469 material participation rules bears mentioning. Section 469 and its companion regulations provide a way for taxpayers to aggregate their trade or business activities into larger grouped trades or businesses. As a generalization, trades or businesses (which is what the Washington state statute appears to talk about) might qualify for the family-owned small business deduction if they meet the requirements and follow the rules described here. But one probably needs to stay alert to the possibility that the state says activity groupings create trades or businesses for purposes of the Washington state capital gains tax. Example 8: Years ago, for purposes of filing his federal income tax return, Andrew appropriately grouped a warehouse he owns (held in an LLC) with a distribution business he owns (in an S corporation) based on self-rental grouping rules embedded in the Section 469 regulations. Because the IRS sees these two activities as a single activity, one wonders if the Washington Department of Revenue would see them as a single trade or business. That unintended consequence would mean that Andrew would not get a qualified family-owned small-business deduction unless he sells both the warehouse and the distribution business to the same buyer. A related thought: Even if Andrew sold both the warehouse and distribution business simultaneously, would two sales to different buyers count as a sale or exchange that disposes of substantially all of the assets? The language of the statue talks about the “sale of substantially all of the taxpayer’s interest in a qualified family-owned small business.” Not “sales” plural, then. But a singular “sale.” And another related thought: If the Washington Department of Revenue would see an activity grouping consisting of a warehouse and a distribution business as a single trade or business, could the business owner first sell the warehouse? (That would presumably not trigger Washington capital gains because real estate gains are exempt from the tax.) Then later, but perhaps even in the same year, the business owner could sell substantially all of the remainder of the previously grouped activities—so just the distribution business. I would guess this works. For what it’s worth. Deduction Detail #8: Use Smart Purchase Price AllocationsSome small businesses get sold as a collection of assets: the inventory, furniture and fixtures, maybe the real estate and then the intangible personal property like the goodwill. Because some of the assets fall into exempt income categories, a seller might want to sell assets rather than the entity. Example 9: Martin owns a small business, Van Buren Inc., that he can sell his stock in for a $750,000 gain. However, he worries he will fail to qualify for the QFOSB deduction because he can’t confidently prove his material participation. Thus, by selling this stock, he might pay the seven percent tax on $500,000 of the gain (assuming the 2022 $250,000 standard deduction.) Alternatively, in an asset sale, he can sell the inventory for a $100,000 gain (not taxed because inventory is not a capital asset), sell the depreciated furniture and fixtures for a $200,000 gain, (statutorily exempt from the Washington capital gains tax), sell the real estate for a $200,000 again (again, statutorily exempt), and thus completely avoid the Washington capital gains tax. Note: Some practitioners wondered how the Department of Revenue would handle purchase price allocations. And the July 2023 rule proposals provide helpful guidance. The proposed rules say that taxpayers can use full appraisal reports, assessor valuation if the assessment date closely matches the sale or exchange date, or the purchase price allocation the seller and buyer use to comply with IRC Section 1060. Predictably, the Department of Revenue reserves the right to change or modify what it views as an inappropriate allocation. Deduction Detail #9: Consider Domicile of OwnersA Washington state domiciliary (basically what tax law usually thinks of as a resident) pays taxes on essentially all of her or his net long-term capital gains. (I’m ignoring the credit for taxes paid to another state if some net long-term capital gains get sourced outside Washington.) For nonresidents, however, only tangible personal property sold or exchanged from a location in the state get hit with the Washington capital gains tax. Tangible personal property, per the administrative rules means “personal property that can be seen, weighted, measured, felt or touched”. Tangible personal property, then, does not include something ephemeral like an interest in a partnership or shares of a corporation. Thus, an out-of-state small business owner might optimize by selling her or his interest in the partnership or the corporation instead of having the partnership or corporation sell its assets. Example 10: Martin’s wife Hanna, also owns a small business, Hannah Hoes Corporation. After Martin sells his business, he and his wife move to Nevada. And then, after establishing residency there, Hannah sells her interest in her Washington corporation for a $1,000,000 gain. She avoids Washington capital gains tax. Deduction Detail #10: Avoid Section 338(h)(10) TreatmentThe modest guidance from the Department of Revenue, at least at the time we’re writing this, suggests to us that taxpayers might want to avoid common but more complex transaction structures. As one example of this, I’d think a taxpayer wants to avoid applying Section 338(h)(10) to a qualified stock purchase transaction. Section 338(h)(10), by the way, treats a sale of stock as a sale of assets. The issue with Section 338(h)(10) is, one might not know how to handle the transaction on a Washington capital gains tax return. Deduction Detail #11: Reconsider Section 754 ElectionsA technical point. I’m not a big fan of making Section 754 elections. (The work required often exceeds the value in my experience.) However, taxpayers and their tax advisors probably want to reconsider Section 754 elections for appreciated property held inside a partnership at the time when the original owner of the property dies and receives a Section 1014 step-up in basis. The reason? The step-up in basis eliminates, or at least minimizes, Washington state’s taxation of long-term capital gains. Deduction Detail #12: Consider Using Trust or Estate OwnershipA final, weird tangential comment: The list of pass-through entities which confer beneficial ownership for an individual excludes estates as well as trusts other than grantor trusts. That means if a nongrantor trust or estate realizes a long-term capital gain, the individuals who are beneficiaries of the estate or trust don’t pay the seven percent tax. Thus, some small business owners may want to move an interest in a small business into a trust or sell an interest held in an estate before realizing the gain. (This gambit also works for capital assets other than interests in small businesses.) Additional Resources for Qualified Family-Owned Small Business Deductions:As noted earlier, we’ve got a “general” blog post over at the CPA firm website that discusses the mechanics of the Washington state capital gains tax including some common tax planning tactics: Washington State Capital Gains Tax Planning The actual statute appears here: https://lawfilesext.leg.wa.gov/biennium/2021-22/Pdf/Bills/Senate%20Passed%20Legislature/5096-S.PL.pdf?q=20210426052154 The most recent July 2023 draft of the administrative regulation appears here: https://dor.wa.gov/sites/default/files/2023-06/20-XXXcr1frmdraftjune23.pdf?uid=64aac2f8dc5d9

The post The Qualified Family-Owned Small Business Deduction appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/rZdSEWn

Back to Blog

Vacation Home Rental Tax Traps7/3/2023

Here’s why: Vacation home rentals present some tax traps for unwary owners. Some big ones. But learn where the traps are? And how they hurt you? You can limit the damage. In same cases, you can even avoid getting blindsided or beat up. This article reviews the rules. The General Vacation Home Rental Tax Rule: Proportional AllocationsA chunk of tax law called Section 280A describes the basic rule regarding accounting for vacation homes. You need to calculate the percent of rental use. And then you can write off that percentage of the expenses but no more than the rental income you earned. This sounds complicated. But in practice? Pretty easy. An example illustrates. You personally used a vacation home for 25 days. You rented the home for 75 days. The rental use equals 75 percent of the overall use. Therefore, you can write off up to 75 percent of the expenses. If your expenses ran $40,000, for example, you can write off as much as $30,000 of expense. But the rub: You can’t write off more expense that you earned in rent. If your rental income equals $40,000, for example, you get to write off the $30,000. But if your rental income equaled $20,000? You can only write off $20,000. Because the last $10,000 of expenses? Disallowed. One bright spot here: Disallowed vacation home expenses—like the $10,000 in the previous example–carry over into future years and may be used then to shelter rental income. Potentially. (You’re subject to the same income limitation.) Anyway, that’s the usual rule. And the main thing to note: You can subsidize the costs of a vacation home by renting. But you can’t generate tax deductible losses. The De Minimis Vacation Home Rental Tax RuleA variety of exceptions to the general vacation home rental rule of Section 280A exist. One is sometimes called the Augusta rule because homeowners in Augusta Georgia, rumor says, make heavy use of it. Note: The real name of this exclusion is the Section 280A(g) exclusion, which you’ll want to know for a reason I’ll explain in a minute. If a homeowner rents her or his home for fourteen days or less and uses it as a residence for more than fourteen days? The homeowner can exclude the income. Note that the homeowner doesn’t get to deduct expenses. But the homeowner enjoys tax free income. Another example illustrates. You own a home in Augusta Georgia. During the Masters Tournament, you can rent your home for $25,000 a week. Due the crazy crowds, you leave home during the tournament and rent your home for two weeks for $50,000. That $50,000? Tax-free income because you rent for fourteen days or less and because you use the home the rest of the home (so more than fourteen days.) Note: You technically shouldn’t have to report the $50,000 of income on your tax return. But because the payor probably will report the income to the Internal Revenue Service? You’ll possibly want to show the income on a Schedule C or Schedule E form. show the Section 280A(g) exclusion as a reduction in that income, and then explicitly calculate the resulting taxable income as “zero.” Minimal Personal Use Dodges Loss LimitationAnother common scenario with vacation rentals. When your personal use is very minimal. When personal use is minimal? You also allocate expenses between personal use and business use. But Section 280A doesn’t prevent you from deducting a loss on the rental. And what level of personal use counts as so minimal it doesn’t trigger the limitation? You need to use property for the lessor of fourteen days or ten percent of the days rented. Another illustration to show the accounting. Suppose you used a vacation property for ten days and rented it for one hundred days. In this case, because your personal use days are not more than ten percent of the one hundred rented days? And also not more than fourteen days? You allocate. But you don’t limit. To be extreme, say you incur $110,000 of expenses. With ten personal use days and one hundred rented days, you treat $10,000 of the expenses as personal expenses and $100,000 of the expenses as business expenses. And the kicker: Because the personal use was so minimal? You wouldn’t get limited to the income. If the rental income equals $40,000 for example? You would still get to deduct $100,000 of expenses. The loss on the property would the be $60,000 (Because $40,000 minus $100,000 equals minus $60,000.) And you’d get to deduct that $60,000 at some point during your ownership of the property. Note: When you can deduct the $60,000 of losses would depend on Section 469 of the Internal Revenue Code. In another blog post, we describe how and when you can deduct these sorts of passive losses. Counting Personal Days Trickier Than You’d GuessA sidebar: You need to be careful about counting days as personal days. Or as rented days. The Section 280A chunk of law makes it easy to lose vacation home rental tax savings. A day spent on maintenance, as long as an adult in the family, works fulltime? That day does not count as personal day. Even if the rest of the family is lounging around. This loophole, by the way, specifically applies to days spend on repairs and maintenance. To be safe, don’t assume you can use a property for some other business-y purpose and call the day a non-personal day. You can’t. Another related wrinkle: Any day you rent a property to someone at below market value? That automatically counts as a personal day. Sorry. Yet another wrinkle: Any day you rent to a family member counts as a personal except when you rent at a fair market rate to a family member for use as primary residence. Finally, a last giant wrinkle to know about. Personal use of a principal residence doesn’t count as personal use days when those days fall before or after a qualified rental period. And what the heck is a “qualified rental period?” Quoting from the law, it’s a “consecutive period of 12 months or more” for which the property is “rented or held for rental at fair market value.” Or it’s a “consecutive period less than 12 months” for which the property is “rented or held for rental” and “at the end of which such dwelling unit is sold or exchanged.” The takeaway here: If you rent your former principal residence for at least twelve months to someone? Or you rent your former personal residence to someone (like maybe the buyer?) who occupies your home after the point you move and before you sell it? Your occupancy doesn’t count as personal days. Which means you don’t get entangled in Section 280A. And the big planning point: You want to minimize your personal days. (Ideally, you want to so minimize your personal days that you don’t see your deductions limited to your rental income.) And if you can, you want to jack up the rental use percentage by having lots of rented days. That way you write off more of your expenses. Other Vacation Home Rental Tax ResourcesThe Internal Revenue Service provides a very useful publication you want to read if you own and may rent a second home: Renting Residential and Vacation Property Note that you use some special accounting rules to pick which expenses get deducted when you report your vacation home rental income and deductions. The publication describes these. We’ve got another copy of blog posts that talk about how to work the short-term rental tax planning opportunity: Tax Strategy Tuesday: Vacation Rental Property and Surviving Short-term Rental Audits.

The post Vacation Home Rental Tax Traps appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/7P068UI

Back to Blog

Critical Hiring Mistakes to Avoid6/10/2023

During the hiring process, candidates will spend a lot of time preparing for the interview and the cover letters they will send out. They will also be thinking about how they will handle the various aspects of the interview and the potential mistakes they could make that could negatively affect their chances of landing a job. We all have the same fears about slipping up or oversharing something that could negatively affect our chances of landing a new job. Many factors go into making a hiring mistake, and the people on both sides of the table can help prevent them from happening in the future. We spoke with several HR professionals and recruiters to understand how organizations and individuals can make mistakes in the hiring process. Vague Job Descriptions Your job descriptions should be updated to attract suitable candidates, and they should be current and accurate to ensure that they can catch potential employees’ attention. Besides writing your expectations, you should also include a variety of other factors that will help the candidate choose your company. These include the expectations of the candidate, the duties, and the soft and hard skills that the candidate should have. Too Specific Then there’s the opposite problem – getting too specific. If you see the same people apply for the same job over and over again – it’s time to start broadening the pool of potential employees. While some positions may require local candidates, most do not. A wider range of candidates can help you attract and retain a diverse talent pool. It can also help you diversify the staff by allowing you to have various skills and perspectives. Today, candidates are not searching the local newspaper for jobs. Instead, they are using various online platforms to apply for their jobs. A resume feed system is one of the most effective ways to attract suitable candidates. This can help you expand your options when it comes to hiring. It can help you reach out to a broader pool of potential employees and increase the number of people who apply for your position. Avoiding Technology There’s a better way to approach the hiring process. When screening candidates, sifting through their resumes is like going back in time. A sound applicant tracking system can help you attract the ideal candidates by driving traffic to your website and then screening them immediately. Instead of going through a briefcase full of resumes, you can schedule in-person interviews and get the job done. Not only is it more cost-effective, but it’s also easier to use. The post Critical Hiring Mistakes to Avoid first appeared on Cuyler Pagano | Business & Entreprenuership.via Cuyler Pagano | Business & Entreprenuership https://ift.tt/VHAj7gd

Back to Blog

I have some good news for you. Your faith community almost surely qualifies for employee retention credits. Big ones. And that’s even if you’re a small group. Why Houses of Worship All QualifyEmployers qualify for employee retention credits in a variety of ways. But one way? When a government order either fully or partially suspends operations. So what that means? Well, you qualify. Probably. The March 23, 2020 proclamation from the Washington State Governor, which prohibited faith communities from gathering, counts as a full suspension from March 23, 2020 through January 11, 2021. And then the January 11, 2021 proclamation, which amended the original closure order with those three “phases” based on infections? That counts as a partial suspension from January 11, 2021 through June 30, 2021. Thus, nearly every Washington state house of worship qualifies. Especially those located in King, Snohomish, and Pierce counties. An Exception to the RuleThe one exception to the every qualifies rule? Faith communities with more than 100 employees in 2020 and more than 500 employees in 2021 including those where the employer is not a single house of worship but a larger ecclesiastical entity. For example, the Roman Catholic Archdiocese of Seattle is the Washington state employer for that community of churches. Not the individual churches or organizations. These large employers face a different set of rules not discussed here. But for nearly everybody else? You almost surely qualify. Employee Retention Credit Refunds Probably $50,000 to $200,000The employee retention credit formula calculates surprising large refunds based on W-2 wages. Most employers gets up to 50 percent of the first $10,000 paid to an employee in 2020 while fully or partially suspended. Usually that means $5,000 for each employee in 2020. Most employers also get up to 70 percent of the first $10,000 paid to an employee in a quarter of 2021 while fully or partially suspended. Usually that means $14,000 for each full-time employee paid in 2021. And then 70 percent of the wages paid to part-time employees during the first half of 2021. Paycheck Protection Program Loans Don’t MatterA clarification: Some people think if an organization received a paycheck protection program loan, it doesn’t qualify for employee retention credits. That understanding is incorrect. Or more accurately out of date. The “you can’t double-dip” rule applied in the beginning. But Congress later changed the law. Claiming the Employee Retention CreditIf you haven’t claimed employee retention credits you’re entitled to? Not a big problem. You need to amend the quarterly 941 payroll tax returns you file with the Internal Revenue Service. In a nutshell, you simply add the employee retention credits you’re entitled to to the return. That creates a refund. You then file the return. And a few weeks or months later, the IRS will send you the check. The one thing you do need to do is explain why you’re entitled to the refund. You’re getting a lot of money back, probably. So you need a detailed statement. Like the one that appears next. You have our permission to copy and paste the statement that appears below into the amended 941 payroll tax return. Copy and paste the from the [Your Faith Community Goes Here] to the link to the [End of Statement] Statement of Explanation for House of Worship Employee Retention Credit[Your Faith Community Name Goes Here] qualifies for employee retention credits for the last three quarters of 2020 and the first two quarters of 2021 based on government orders from Washington state governor Jay Inslee that either fully or partially suspended operations from March 23, 2020 through June 30, 2021. PERIOD OF FULL SUSPENSIONFrom March 23, 2020 through January 11, 2021, the faith community qualifies for employee retention credits due to the “full suspension of activities due to a government order” rules of section 2301 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and the related guidance in IRS Notice 2021-20, IRS Notice 2021-23 and IRS Notice 2021-49. Quoting from page 4 of that proclamation,

Note: Links to all of Governor Inslee’s COVID-19 proclamations which repeatedly extended the shutdown the operations of faith communities, appear here: The government order that ends the period of full suspension is the “PROCLAMATION BY THE GOVERNOR AMENDING PROCLAMATIONS 20-05 and 20-25, et seq. 20-25.12 “HEALTHY WASHINGTON – ROADMAP TO RECOVERY” issued on January 11, 2021. PERIOD OF PARTIAL SUSPENSIONFrom January 11, 2021 through June 30, 2021, the faith community qualifies for employee retention credits due to the “partial suspension of activities due to a government order rules of section 2301 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Pub. L. No. 116-136, 134 Stat. 281 (March 27, 2020), as amended by section 206 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act), enacted as Division EE of the Consolidated Appropriations Act, 2021, Pub. L. No. 116-260, 134 Stat. 1182 (December 27, 2020) and again the related guidance in IRS Notice 2021-20, IRS Notice 2021-23 and IRS Notice 2021-49. The government order that starts the period of partial suspension is the previously referenced “PROCLAMATION BY THE GOVERNOR AMENDING PROCLAMATIONS 20-05 and 20-25, et seq. 20-25.12 “Healthy Washington – Roadmap to Recovery” issued on January 11, 2021. That proclamation specifically expands the state’s COVID-19 orders to include the “Healthy Washington – Roadmap to Recovery” document and plan. That document and plan creates three phases of operation for faith communities: Phase 1, phase 2 and phrase 3. During phase 1 and phase 2, which run from January 11, 2021 through May 18, 2021, faith communities can operate their indoor worship services, their principal operation, but only at 25 percent or less capacity. Phase 1 and 2 therefore represent a 75 percent reduction in capacity based on hours of service and therefore a more than a nominal reduction in hours of service. During phase 3, which runs from May 18, 2021 through June 30, 2021, faith communities can operate indoor worship services but only at 50 percent or less capacity. Phase 3 therefore represents a 50 percent reduction capacity and therefore again a more than a nominal reduction in hours of service. The government order that ends the period of partial suspension is PROCLAMATION BY THE GOVERNOR AMENDING PROCLAMATIONS 20-05 and 20-25, et seq. 20-25.13 “HEALTHY WASHINGTON – ROADMAP TO RECOVERY” issued on May 21, 2021. Quoting from that order,

Proclamation 20-25.12 is available here: https://governor.wa.gov/sites/default/files/proclamations/proc_20-25.13.pdf The Healthy Washington—Roadmap to Recovery document is available here: https://governor.wa.gov/sites/default/files/2023-01/HealthyWashington.pdf [END OF STATEMENT] Does Your Church, Mosque, Temple or Synagogue Need Help?If you’re a Washington state employer and you can’t do the amended returns yourself? We’re happy to help your organization amend the returns. We won’t do the work for free. But the price will be very affordable. Turnaround time in usually a few days. You can contact us here: Nelson CPA. Other ResourcesHere’s a long discussion of how houses of worship handle employee retention credits: Houses of Worship Miss Boat on Employee Retention Credits

The post Washington State Houses of Worship All Qualify for Employee Retention Credits appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/r8fVFS4

Back to Blog

The Importance of Delegation5/17/2023

One of the most important factors that businesses consider when it comes to delegation of authority is the development of conditions that will allow them to use their inner power effectively. This process can benefit a small business or a large firm. A delegation is the assignment of some responsibilities to a subordinate by a superior. It usually involves the approval of the subordinate’s superior. Frees up Time Leaders must have the proper balance between their job’s tactical and strategic aspects to be effective. Delegation can help leaders focus on higher-value activities, and it can also free them from time-consuming tasks. It allows them to think critically and lets them concentrate on other essential tasks, such as coaching their teams. Boosts Morale & Confidence The relationship between a superior and a subordinate is built on the delegation of authority. When associates have authority over their work, they are more motivated to perform at their best. They also tend to be more cautious and put more effort into their tasks. This can result in the employees’ positive outlook on their work. Prioritizes Tasks The delegation process starts with identifying the tasks that can be delegated and those that can’t. It then prioritizes the important items that the delegated individuals should handle. One of the most effective tools leaders can use to develop a prioritization system is the Urgent vs. Important Matrix. This allows them to categorize their tasks according to their importance and time sensitivity. Some tasks, such as responding to an urgent request from another team, can be delegated. Critical and crucial tasks can also be candidates for delegation depending on the experience level of the team member. Finding that Team Spirit The delegation of authority can help develop an efficient communication channel between subordinates and superiors. Both parties are expected to respond to each other’s questions and suggestions. This establishes a stronger working relationship between the two parties. More Efficient The delegation of authority can also help employees make the necessary decisions to resolve their problems. It eliminates the need for them to go to their superiors for any day-to-day issues. This eliminates wasted time and helps improve the efficiency of an organization. The post The Importance of Delegation first appeared on Cuyler Pagano | Business & Entreprenuership.via Cuyler Pagano | Business & Entreprenuership https://ift.tt/M4P1oy3

Back to Blog

And how do you do this? Consider the following six hacks to simplify your small business accounting and taxes: Operate Sole ProprietorshipYou can operate a business using a variety of entities: sole proprietorship, corporation, partnership, and so on. But to keep things simplest? At least in the beginning? Use a sole proprietorship. That simplifies your accounting. (You’ll only need a profit and loss statement.) And it simplifies your taxes. (You’ll just report your income on a Schedule C form inside your regular individual income tax return.) Use Limited Liability CompanyConcerned about your legal liability? Tempted to incorporate? Maybe reconsider that. You should be able to form a limited liability company, or LLC. And if the LLC has a single owner—called a member—you’ll get to use the sole proprietorship entity classification. Even though you’ve limited your liability risks. Note: We give away free copies of do-it-yourself kits for forming LLCs for most states. Go with Cash Basis AccountingHere’s another tactic. Keep your bookkeeping simple by using cash basis accounting. Count income when you receive payments, for example. And count expenses when you make payments. The alternative to cash balance accounting? Accrual accounting. But accrual accounting greatly complicates your work. Use Equity Not DebtYour capital structure will either make your accounting and bookkeeping harder or easier. But one thing you can do to keep things easier? Use owners equity to fund the business. In other words, don’t use a bunch of debt to fund the business. Or parts of the business. Leveraging up your small business with debt obviously increases your financial risks. But even beyond that? It makes your accounting way too complicated. Keep Balance Sheet SparseA related suggestion? Keep your balance sheet lean. Clean. As sparse as you can. So of course your balance will show cash. Maybe some inventory. But anything else? Try to avoid that. If you avoid debt, that of course keeps your balance sheet lean and clean. And then the other thing to do: Don’t put a bunch of assets onto the balance sheet. Write off as supplies anything that costs $2500 or less. Or that probably lasts less than a year.(See this blog post for more information: Tangential Property Regulations.) And then, sorry, don’t buy vehicles and put them onto the balance sheet. Or anything that IRS considered a so-called “listed asset” which triggers extra reporting. (Cars are listed assets. And so is other stuff that’s likely to be used personally.) Use a SEP as Pension OptionThe easiest pension option? Just skip a formal pension and use an Individual Retirement Account. Maybe one for your spouse, too, if you’re married. If you want to put bigger numbers onto your return, look at using a SEP-IRA plan. That’ll let you contribute up to 20 percent (roughly) of your business profit up to about $60,000 a year. (The limit in 2022 is $61,000 but that limit gets adjusted for inflation.) With a SEP-IRA? You just shuffle some paperwork. And then sometime before the tax return filing, decide whether or not you want to contribute to the SEP-IRA account. Outsource PayrollWhen or if you hire employees? Outsource the payroll. Do not do this yourself. Or even a worse idea do this for your spouse’s business. You can outsource payroll to someone like Gusto.com. Pay a few hundred bucks a year. And get all your payroll taken care of: quarterly returns, tax deposits, W-2s and so on. Shoulder Season SchedulingA final idea: If you do need help from a CPA or bookkeeper? Well, first, don’t wait until the last minute. Terrible labor shortages exist in the world of accounting right now. And that will probably continue, especially for CPAs, for years. (It takes about five years to get the schooling necessary to become a CPA. And it probably takes another five years to really know how to do the job.) And then if you can, try to schedule your work outside of tax season. Schedule your working with CPAs and bookkeepers in the shoulder season that falls between April 15 and the fall extended tax return season. The post Six Hacks to Simplify Small Business Accounting and Taxes appeared first on Evergreen Small Business. via Evergreen Small Business https://ift.tt/aYCVjvw

Back to Blog

Habits of Successful Entrepreneurs4/8/2023

High-profile investors, entrepreneurs, and billionaire individuals are some of the terms that people often associate with these people. However, they don’t understand how these individuals put their lives on the line to achieve their goals. Getting motivated and excited about starting a business can be very challenging. It can also get hard to keep track of all the details of the project and the people involved. In the coming years, if you plan on becoming an entrepreneur, this article will help you identify the habits that will help you along the way. Maintain A Routine One of the most important habits that a successful entrepreneur should start with is maintaining a strict schedule. This will help them keep track of all the details of their work and ensure that they get enough time to relax. Having a consistent schedule helps them make time for everything important to them, such as family time. Make Quick Decisions Another essential habit that an entrepreneur can implement is the ability to make quick decisions. This will allow them to get things done more efficiently and effectively. Unfortunately, making decisions too quickly can be detrimental to their business. However, instead of getting trapped in analysis paralysis, entrepreneurs should be able to make decisions that are most likely to lead to success. They should also be willing to change their course if necessary. Get a Head Start One of the most critical habits an entrepreneur can implement is getting a head start on their day. This will allow them to ensure that they are paying attention to the important things they need to do today. We tend to put off specific tasks and projects until we know the most difficult problem. This is a natural tendency, but it should not be allowed to get carried away. Instead, try to do a few easy things today to improve your productivity. Read Often Since being an entrepreneur can be very hectic, it can be hard to make time for reading. According to experts, reading can help build knowledge and stimulate creativity. Apart from helping entrepreneurs learn more about their industry, reading before bed can also help them get a better night’s sleep. The post Habits of Successful Entrepreneurs first appeared on Cuyler Pagano | Business & Entreprenuership.via Cuyler Pagano | Business & Entreprenuership https://ift.tt/YURrx6G |

RSS Feed

RSS Feed